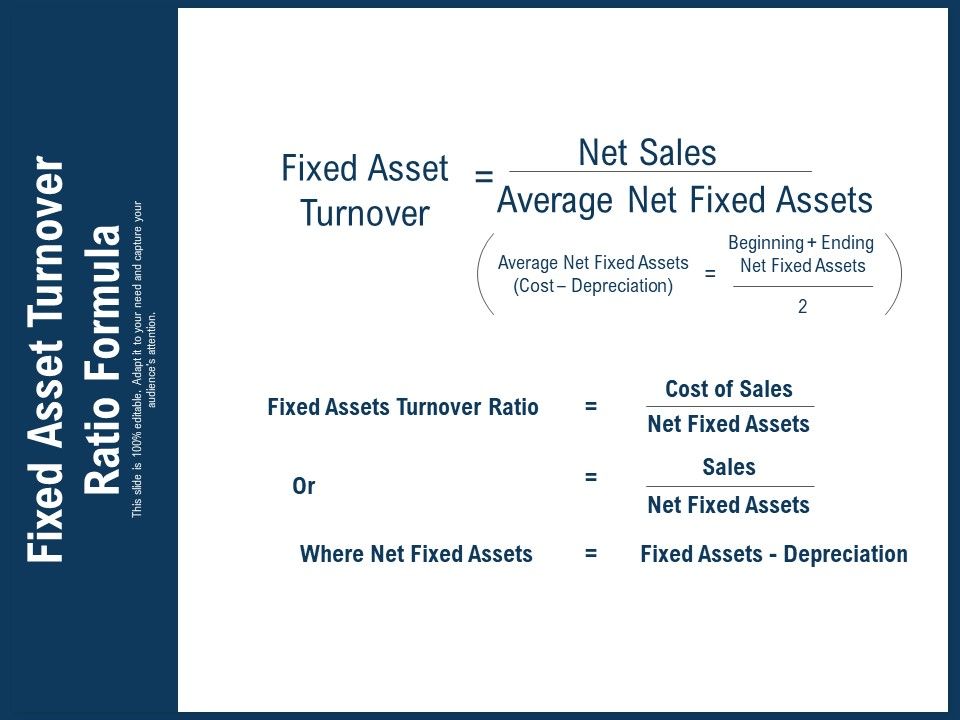

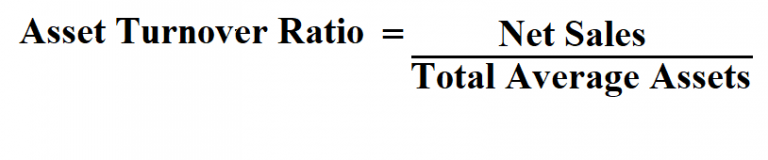

A business that has higher asset turnover is considered to be more efficient. Analyzing your income statement will help. What is a Good Asset Turnover Ratio?Ī good asset turnover ratio depends upon your industry peers and how well similar companies are doing. This tells us that for every dollar of assets the company has, it generates $1.10 in sales. The asset turnover ratio for Coca-Cola in this example is 1.1. The formula for asset turnover ratio is: Revenue divided by average total assetsĬoca-Cola has sales of $27 billion, average total assets of $25 billion, and net income of $3.7 billion.Īsset Turnover Ratio = Sales/Average Total Assets = 27/25 = 1.1 It can also be considered an efficiency ratio. Using average assets gives a better estimate of how effective they are at producing revenue. This is useful in industries where companies have large amounts of expensive machinery that sits idle for most of the year. This only counts the average dollar amount of fixed assets used each year to generate revenue.

Good asset turnover ratios lead to more consistent cash flow.Ī more complicated version of asset turnover is “fixed asset turnover”. The more a company focuses on the use of its assets, the higher the turnover rate will be. A business’s asset turnover ratio will vary depending upon the industry in which it operates. It can be calculated for a single month or any other period of time. Asset turnover is most often measured on an annual basis.

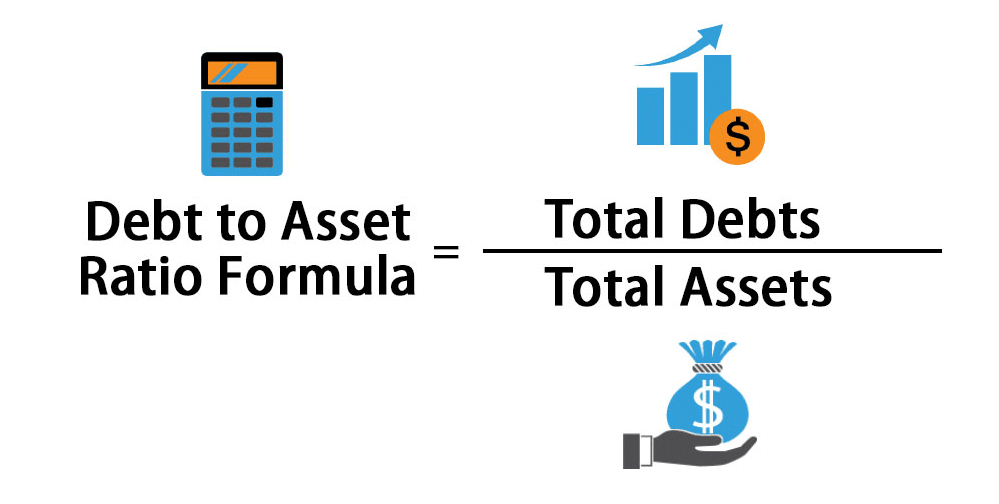

They are used by both managers and investors. It shows how many dollars in sales are generated for each dollar of assets invested in the business.Īsset turnover ratios are also referred to as “sales to assets ratios”. More specifically, it is the ratio of sales divided by total assets. Key Takeaways What Is an Asset Turnover Ratio?Īsset turnover ratios are a measure of how effectively the company is using its assets to generate revenue.

#Total assets turnover ratio formula how to

How to Use Asset Turnover Ratios to Analyze Companies You’ll learn what they are, how you can use them to analyze businesses and more. This article will discuss all you need to know about asset turnover ratios. They can also be used internally by managers to evaluate their various divisions. They can be used to compare one company with another. Send invoices, track time, manage payments, and more…from anywhere.Īsset turnover ratios are a measure of how effectively the company is using its assets to generate revenue. Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one placeįreshBooks integrates with over 100 partners to help you simplify your workflows

Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Tax time and business health reports keep you informed and tax-time ready Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

#Total assets turnover ratio formula professional

When analyzing financial ratios of several different but similar companies, a company can better understand whether it is an industry-leader or whether it is falling behind.Wow clients with professional invoices that take seconds to create How it is performing compared to its competitors.When analyzing financial ratios of a single company over time, that company can better understand the trajectory of its accounts receivable turnover. Slower turnover of receivables may eventually lead to clients becoming insolvent and unable to pay. If a company's accounts receivable turnover ratio is low, this may be an indicator that a company is not reviewing the creditworthiness of its clients enough. How sufficiently a company is evaluating the credit of clients.A company can project what cash it will have on hand in the future when better understanding how quickly it will convert receivable balances to cash. When it might be able to make large capital investments.Some lenders may use accounts receivable as collateral with strong historical accounts receivable activity, a company may have greater opportunities to borrow funds. What collateral opportunities a company may have.As a company processes receivable balances faster, it gets its hand on capital faster. How well a company is collecting credit sales.

0 kommentar(er)

0 kommentar(er)